Predict cash flow problems 8 weeks in advance

vs 30 days later

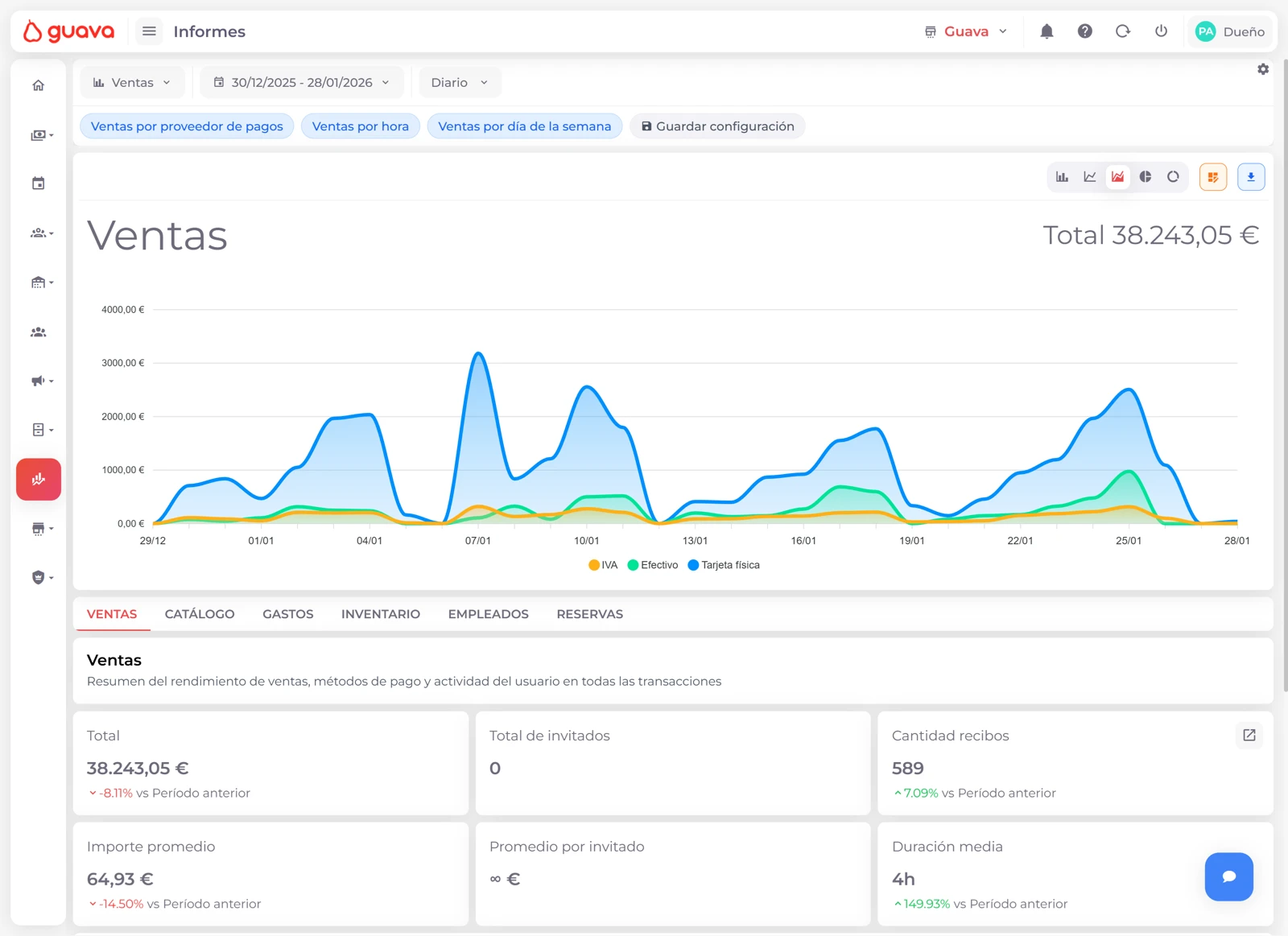

Forecasting with 85% accuracy 8 weeks ahead predicting revenues, costs, and cash flow. Detect cost deviations in 24h vs 30 days with accounting closure. Clients adjust 2-4 weeks before running short of cash.

Accounting tells you what you lost 30 days ago.

Guava tells you what you'll lose in 8 weeks.

Every day of delay in detecting cash flow problems costs €200-500 in wrong decisions. Monthly accounting closure means seeing problems 30-45 days late. Weekly forecasting means adjusting 6-8 weeks before running short.

See where the money is going, clearly.

When costs are visible, margins start to make sense. Automatically categorize every dollar.

Recurring Expenses

Subscriptions, rent, and fixed contracts. Know exactly what goes out of the bank every month.

Inventory and COGS

Track raw materials and stock purchases against your sales volume in real-time.

Marketing Spend

Connect advertising spend with revenues. See if your CAC is healthy or affecting your margins.

Labor Efficiency

Last 7 daysPredicted labor cost per day vs surprise at month-end

Correlate shifts, hours worked, and sales to predict daily labor cost. Detect overstaffing 2-4 weeks before payroll vs finding out at month-end. Every saved labor cost point = €300-400/month in a 30K revenue location.

Anticipation vs Reaction

Seeing you're 4 points above target in week 2 gives you 2 weeks to adjust. Seeing it at month-end means you already spent €400-600 extra.

See the future before it arrives.

Prediction turns anxiety into preparation. We model revenues, costs, and cash impact based on historical data, seasonality, and live trends.

4th Quarter Projection

Guava explains deviations automatically.

Costs are increasing 15% more than forecasted this week.

Mainly due to price increases from Company X's suppliers and higher than expected overtime on Tuesday.

Revenue target is at risk for October.

Based on current booking pace, you're projected to miss the target by €12k. Consider a mid-month promotion.

You don't forecast manually. You get explanations.

Set goals that make sense.

Goals stop being abstract. Set specific goals for revenues, profit margin, or labor cost ratios. Guava tracks progress daily.

From goal to execution.

If you stray off course, Guava suggests actionable adjustments.

Adjust Staff Grid

High ImpactReduce Tuesday and Wednesday shifts by a total of 15 hours to align with a forecasted lower customer traffic.

Supplier Renegotiation

Medium ImpactCost of goods sold for the main ingredient increased by 5%. Notify the supplier of the volume target to negotiate the price.

One view. Past, present, future.

No exports. No spreadsheets. No guesswork.

| Metric | Actual (Oct) | Forecast (Nov) | Goal | Status |

|---|---|---|---|---|

| Total Revenues | €124,500 | €132,000 | €130,000 | In Progress |

| COGS % | 28% | 27.5% | 28% | Healthy |

| Labor Cost % | 32% | 34% | 30% | Attention |

| Net Profit | €18,400 | €21,200 | €22,000 | At Risk |

Finance without pressure.

Feels like control, not judgment.

Simple Language

We don't speak in accounting codes. We tell you what's happening in words you use every day.

Early Alerts

No bad news at month-end. Get alerts when you veer off course, while you can still fix it.

Decision Focus

We don't just report numbers. We highlight the few key decisions that will actually move the needle.

Perfect for you if...

- You have predictable margins but unsure where profits are leaking.

- Need to make weekly decisions on staff and pricing.

- Want long-term stability over short-term chaos.

Not for you if...

- You only want CSV exports for your accountant.

- Prefer complex spreadsheets over simple answers.

- Don't intend to act on the provided insights.